Taking the first step into the entrepreneurial arena is fraught with risks and uncertainty. A quality choice of geographical location for launching a business can significantly reduce the impact of unknown variables and increase the probability of a successful outcome. Among the regions available for entrepreneurship around the world, UAE stands out as a particularly promising zone.

Initiating business processes is tantamount to investing in your prosperity on one of the most impressive global business platforms. UAE is not just a group of seven emirates combined into a single political structure, it's a portal to international entrepreneurship, hospitably open for those ready to meet this challenge.

Initiating business processes is tantamount to investing in your prosperity on one of the most impressive global business platforms. UAE is not just a group of seven emirates combined into a single political structure, it's a portal to international entrepreneurship, hospitably open for those ready to meet this challenge.

UAE as a Global Business Hub

Starting a business activity can be viewed as a strategic investment in a future full of possibilities. This choice provides you with a competitive advantage, expands access to global markets and labor potential, and offers the opportunity to enjoy a high standard of living.

- Sector Diversification: Offers numerous opportunities for business sectors, from the oil and gas industry to the space sector.

- Stability: A safe country with a low crime rate, providing a stable platform for business. Attractive

- Tax System: Offers a free trade policy and the absence of some taxes.

- High Standard of Living: Combines high-quality infrastructure and plenty of opportunities.

- Support for Innovations: Stimulates innovative enterprises and technologies.

- Qualified Workforce: Liberal immigration policy attracts specialists from all over the world.

- Simplification of Business Processes: Strives to minimize bureaucracy and simplify doing business.

- World-Class Infrastructure: Has infrastructure for effective business operation.

Analysis of Jurisdictions in UAE

The UAE comprises various jurisdictions, including Onshore (Mainland), Free Zones, and Offshores, each with unique advantages and requirements.

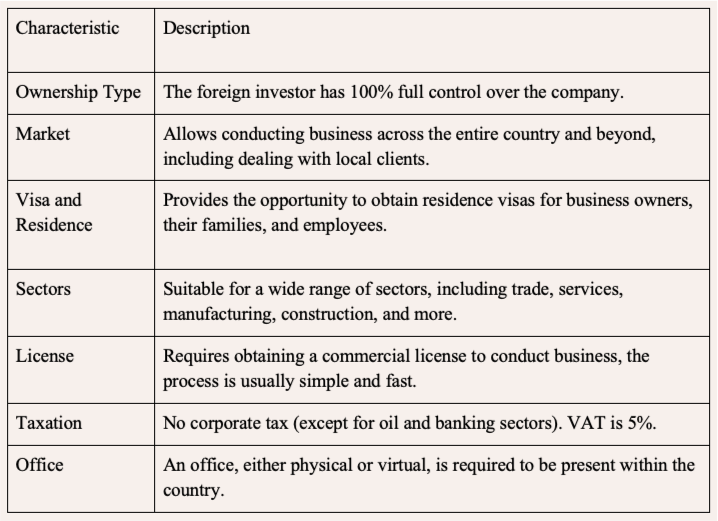

● Onshore (Mainland):

● Onshore (Mainland):

- Access to all markets without restrictions.

- No minimum capital requirements.

- 100% ownership stake for a foreign investor.

Important aspect

The application and licensing process is conducted through the DED, with registration taking place at the Chamber of Commerce. Foreigners can obtain a two-year visa following registration. A local sponsor is not required, as the investor can sponsor their own family. Company setup can be done online, but visa requires personal presence in the UAE.

● Free Zones:

- 100% foreign ownership.

- Complete exemption from corporate tax.

- No customs duties on the import and export of goods.

- Restrictions on conducting business outside the free zone.

Important aspect

The registration process in the Free Zone involves choosing the appropriate zone, submitting an application, and paying fees. The owner has full control over the company and is eligible for a two-year visa, which can also be arranged for family members. The company can be set up online, however, personal presence in the UAE is required for visa processing.

● Offshores:

- 100% foreign ownership.

- Absence of taxes on profits and royalties.

- Cannot conduct business inside.

- Used for tax optimization and asset protection.

Important Aspect

Offshore companies require incorporation documents, identity verification, and a registered office in UAE. They cannot conduct business in UAE and get a resident visa. An investor visa is available in some jurisdictions, for example, Ras al Khaimah.

Dubai Internet City specializes in IT companies, while Dubai Healthcare City offers an infrastructure for medical organizations. Offshore jurisdictions, including Ras al Khaimah and Jebel Ali, have strict anti-fraud and anti-money laundering laws, ensuring their reliability.

Mainland Local Company

Onshore companies, or "mainland," are legal entities registered in UAE's main jurisdiction.

They have several advantages, including access to a broader market, the ability to obtain resident visas, and the absence of corporate tax. However, before starting a business in this jurisdiction, it's important to study all legal requirements and obligations.

They have several advantages, including access to a broader market, the ability to obtain resident visas, and the absence of corporate tax. However, before starting a business in this jurisdiction, it's important to study all legal requirements and obligations.

Free Economic Zones FEZ

Free zones provide foreign investors with 100% ownership of a company, and a simplified registration procedure, without the need to involve a local sponsor or agent. This gives full control over the operational activities and financial flows of the company.

UAE's FEZ visa process is also simplified. Business owners are guaranteed a resident visa for two years with the possibility of an extension. In addition, there is an opportunity to obtain visas for family members of the company owner.

Hence, the procedure for registering a business and obtaining residency in UAE's FEZ is a convenient mechanism for investors aiming to implement commercial strategies in business-oriented international jurisdictions.

● Dubai Multi Commodities Centre (DMCC) - a prestigious zone, that attracts companies dealing with commodity markets, such as gold, diamonds, and tea. DMCC provides access to modern infrastructure, including warehouses, offices, and residential buildings.

● Dubai Silicon Oasis (DSO) - a zone specializing in technology and IT companies. DSO offers support for startups and high-tech enterprises.

● Dubai Healthcare City (DHCC) - a zone providing healthcare companies access to modern medical infrastructure and qualified professionals.

● Meydan Freezone (MFZ) is an international trading platform for businesses of all sizes. MFZ ensures easy start-up with 100% foreign ownership and a 50-year tax holiday. Physical offices are absent, virtual is available.

● International Free Zone Authority (IFZA) offers services in company registration, virtual office, and ensures 100% foreign ownership. Its efficiency and speed of processing make IFZA attractive to investors.

● Ras Al Khaimah Economic Zone (RAKEZ) stands out for its strategic location, proximity to international ports and airports, and affordable prices. This zone offers a wide range of industrial, commercial, and service licenses, providing a high degree of flexibility for business.

UAE's FEZ visa process is also simplified. Business owners are guaranteed a resident visa for two years with the possibility of an extension. In addition, there is an opportunity to obtain visas for family members of the company owner.

Hence, the procedure for registering a business and obtaining residency in UAE's FEZ is a convenient mechanism for investors aiming to implement commercial strategies in business-oriented international jurisdictions.

● Dubai Multi Commodities Centre (DMCC) - a prestigious zone, that attracts companies dealing with commodity markets, such as gold, diamonds, and tea. DMCC provides access to modern infrastructure, including warehouses, offices, and residential buildings.

● Dubai Silicon Oasis (DSO) - a zone specializing in technology and IT companies. DSO offers support for startups and high-tech enterprises.

● Dubai Healthcare City (DHCC) - a zone providing healthcare companies access to modern medical infrastructure and qualified professionals.

● Meydan Freezone (MFZ) is an international trading platform for businesses of all sizes. MFZ ensures easy start-up with 100% foreign ownership and a 50-year tax holiday. Physical offices are absent, virtual is available.

● International Free Zone Authority (IFZA) offers services in company registration, virtual office, and ensures 100% foreign ownership. Its efficiency and speed of processing make IFZA attractive to investors.

● Ras Al Khaimah Economic Zone (RAKEZ) stands out for its strategic location, proximity to international ports and airports, and affordable prices. This zone offers a wide range of industrial, commercial, and service licenses, providing a high degree of flexibility for business.

Important Aspect

The choice of a free zone depends on the type of business, required infrastructure, target market, and long-term goals. Offshore companies also have unique features.

Companies registered in UAE offshore jurisdictions

Offshore jurisdictions provide unique opportunities for business entities aiming to minimize their tax obligations and optimize operational efficiency.

The advantages of incorporating an offshore company include:

The advantages of incorporating an offshore company include:

- Fiscal preferences: Offshore companies are exempt from paying taxes, including income tax and corporate tax.

- Privacy: Incorporating an offshore structure ensures a high level of confidentiality for shareholders and directors, as their data is not subject to public disclosure.

- No restrictions on repatriation of profit and capital: Offshore legal entities can repatriate their capital gains and assets out of the country without hindrance and tax obligations.

- Simplified corporate governance: Offshore structures have a simplified corporate governance structure, which makes their management easier and more efficient.

- No requirement for physical presence: Offshore companies are not required to have a physical office in the country.

- Offshore jurisdictions, including Ras Al Khaimah and Jebel Ali, have stringent anti-fraud and anti-money laundering laws, ensuring their reliability.

Key points

Companies registered in offshore zones do not have the right to conduct commercial activity in the country and cannot issue visas for staff. They are obliged to comply with international standards against money laundering and terrorist financing.

Launch your business in UAE with "Polaris"!

Considering the multitude of business advantages and opportunities offered by the UAE - now is the time to start realizing your ambitions. However, launching a business in a new country can be a complex task, requiring a thorough knowledge of local legislation and an understanding of the market situation. In this context, "Polaris" company will be your reliable partner.

"Polaris" experts have deep knowledge and extensive experience working in UAE, and they are ready to assist you at every stage of the business launch process. We will help you choose a suitable jurisdiction, prepare all the necessary documentation, obtain licenses and resident visas. Our main goal is to simplify the business launch process as much as possible, making it easy and understandable for you.

Don't put off your ambitions for later! With "Polaris", the business launch process becomes fast, simple, and reliable. Together, we can turn your business ideas into successful and profitable projects.

"Polaris" experts have deep knowledge and extensive experience working in UAE, and they are ready to assist you at every stage of the business launch process. We will help you choose a suitable jurisdiction, prepare all the necessary documentation, obtain licenses and resident visas. Our main goal is to simplify the business launch process as much as possible, making it easy and understandable for you.

Don't put off your ambitions for later! With "Polaris", the business launch process becomes fast, simple, and reliable. Together, we can turn your business ideas into successful and profitable projects.